The Value of a College Degree

In today’s world, there is a strong debate among various groups over the value of higher education. More and more, Americans are questioning whether the cost of a degree is worth the potential benefits. The case of whether a college degree is worth it is highly individualized, based on a person’s higher education institution, their degree and career path, and the ways that they plan to fund their education. Before making a blanket statement of whether college is worth it, one should explore and understand each of these concepts that goes into the question.

Types of Higher Education Institutions

American students have a variety of higher education institutions they can choose to attend, including community colleges, technical colleges, four year universities, and for-profit institutions.

Starting at a more local level, we have community and technical colleges. Community colleges, as the name implies, are colleges based in local communities. These higher education institutions offer two year associates degrees and non-degree credentials. In many cases, community colleges also offer Dual Credit classes to their local high schools, or community based classes that anyone in the district can attend. Out of all the higher education options, community colleges are the most cost effective. In 2024, the average full-time cost of an Illinois community college was $4,710 annually, or $2,355 a semester. Public four year Illinois colleges on average cost $15,219 in tuition and fees annually, and private Illinois colleges cost $44,287. Additionally, since completing an associates degree only takes two years, this can mean a student can enter the workforce more quickly than a traditional bachelors degree holder.

Technical colleges, also known as trade or vocational schools, offer specialized training programs that helps prepare students for specific career paths or trades. These programs are known to rapidly train their students to enter the workforce quickly. These colleges emphasize hands-on experiences and apprenticeships over traditional classroom lectures. These can be good options for students interested in the trades. However, some trade schools may be rather expensive, and may not have the best reputation. Students should always research their college’s graduation and employment placement rates, as well as their general reputations. They should also compare financial aid packages, as many community colleges offer technical training programs, and may have access to more forms of financial assistance.

Four-year universities are higher education institutions that offer bachelors, masters, and doctorate programs. Universities can be public, meaning their funding comes primarily from the government, and their costs tend to be lower than private colleges. Private colleges make their money primarily from tuition and private sources, and may be more expensive than public universities, but at the same time may offer more generous financial aid packages. Although four year public and private universities may have more competitive or extensive educational programs, students should also be aware that their costs can be significant. Many students opt to complete their general education requirements at their local community college before transferring to a four year institution, which can save them thousands of dollars in educational expenses.

Degree and Career Pathways

When discussing the value of an education, individuals should also look at what degree programs interest them, how those can help them in their eventual career pathways, and how a degree can impact their income prospects.

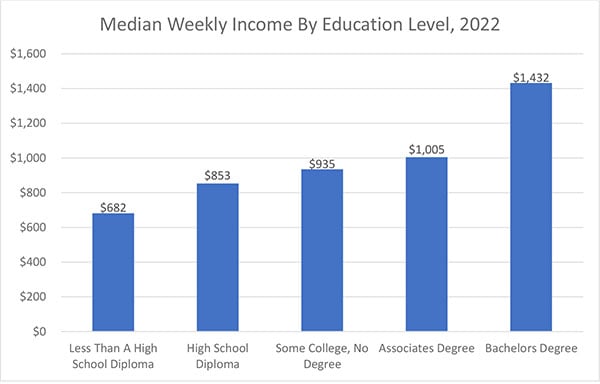

Generally, research has shown that the more education an individual has, the higher their median income is. According to the Bureau of Labor Statistics, below is a graph showing the median weekly incomes of various educational levels in America:

Source: https://www.bls.gov/careeroutlook/2023/data-on-display/education-pays.htm

In addition, individuals have a lower likelihood of experiencing unemployment the higher their education level is. Individuals with a high school diploma experience an unemployment rate of 4%, while those with associates degree experience an unemployment rate of 2.7%.

However, it should be noted that the above data is based only on medians and averages. Each degree program has its own potential career pathways, and each career pathway has its own income prospects. For example, in 2023, the median pay of a dental hygienist was $87,530 annually. The typical entry-level dental hygienist needs an associates degree. Compare this to the median pay of a social worker, which typically requires at least a masters degree: $58,380.

Before starting college, students should understand the career pathways they can access through their degree, and the median incomes each career pathway offers. Additionally, students should understand that many individuals end up in career paths that do not directly correspond to their degrees they graduate with.

How to Pay for Educational Expenses

Finally, when considering if a college degree is worth it, one should examine the ways they plan to fund their education. Overall, graduating with the least amount of debt possible is the best way to build a solid financial foundation for post-college life. But, completely avoiding any type of education debt may impede an individual’s ability to complete their degree, or be impossible in some cases to avoid.

First, students should take advantage of as many free sources of financial aid as possible. The first step in the financial aid process is filing out a Free Application for Federal Student Aid, also known as the FAFSA*. The FAFSA allows access to a variety of federal, state, and institutional aid. For Illinois students, the two most common financial aid options they are offered through the FAFSA are the Federal Pell Grant and Illinois MAP Grant. There are also industry / major specific grants, such as the Federal TEACH Grant and the Illinois Nursing Education Scholarship Program (NESP).These are funds that help pay for higher education costs, and do not have to be paid back. You can also be granted access to federal student loans, which will be discussed at greater length later.

After a student completes their FAFSA, they should search for additional financial aid in the form of scholarships. Scholarships are another form of free financial aid that does not have to be paid back. Scholarship funds can be used for a variety of educational costs, as outlined in their descriptions. Students should first look at local sources of scholarships, such as the school they are attending, local community foundations, or even through their employers. Some employers offer tuition assistance programs to their employees and their dependents (reach out to your HR office to see what options are available to you). Then, after such resources are exhausted, students can move onto more broad, national scholarships.

Once all grant and scholarship sources have been exhausted, a student can potentially look at student loans to help pay for the rest of their educational expenses. In 2024, 42.8 million Americans held some form of student loans, with an average balance of $40,681. Students should aim to take out as minimal of student loan debt as possible. Additionally, students should take advantage of federal student loans before exploring private loan options. This is because some federal student loans (specifically, subsidized loans) do not accrue interest while the student is in classes. Also, federal loans tend to have lower interest rates, more flexible payment options, and the potential to be forgiven in the future (although, student loan forgiveness is never a guarantee).

Being a responsible student loan borrower takes work. Students should not simply accept the maximum amount of loans they qualify for. Instead, they should carefully calculate how much their education will cost them. A simple version of this calculation can be seen below:

- Add: Tuition, fees, books and supplies, and relevant living expenses

- Subtract: Grants and scholarships received

- Subtract: Income earned from work

- Subtract: Savings the student wishes to use for their education.

- Subtract: Any payment plans a student can reasonably afford

- Equals: The amount left over to cover educational expenses

- Students can visit their college’s financial aid office to understand their educational expenses in more depth. As long as student loans are used minimally, responsibly, and as the last option to fund expenses, most students should be able to avoid being overburdened with debt.

Overall, the question “is a college degree worth it” has a variety of nuanced responses. For an individual wishing to pursue a degree that will lead to higher income, better job prospects, and minimal debt, the answer may be yes. For those wishing to immediately enter the workforce after high school, a technical credential or associates degree may be a better option than a bachelors. No matter what, a student should educate themselves on the value of their individual career path, and make the decision based on their own wants, needs and goals in life.

Sources:

- https://www.pewresearch.org/social-trends/2024/05/23/is-college-worth-it-2/

- https://www2.iccb.org/data/wp-content/uploads/2023/12/Cost_FY24.pdf

- https://www.bls.gov/ooh/healthcare/dental-hygienists.htm

- https://www.bls.gov/ooh/community-and-social-service/social-workers.htm

- https://educationdata.org/student-loan-debt-statistics